Renters Insurance in and around Indianapolis

Get renters insurance in Indianapolis

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Your rented condo is home. Since that is where you rest and relax, it can be advantageous to make sure you have renters insurance, especially if you could not afford to replace lost or damaged possessions. Even for stuff like your kitchen utensils, bed, entertainment center, etc., choosing the right coverage can make sure your stuff has protection.

Get renters insurance in Indianapolis

Your belongings say p-lease and thank you to renters insurance

Open The Door To Renters Insurance With State Farm

Many renters underestimate the cost of refurnishing a damaged property. Your valuables in your rented home include a wide variety of things like your exercise equipment, video game system, couch, and more. That's why renters insurance can be such a good choice. But don't worry, State Farm agent Keith Eberg has the efficiency and experience needed to help you choose the right policy and help you protect your belongings.

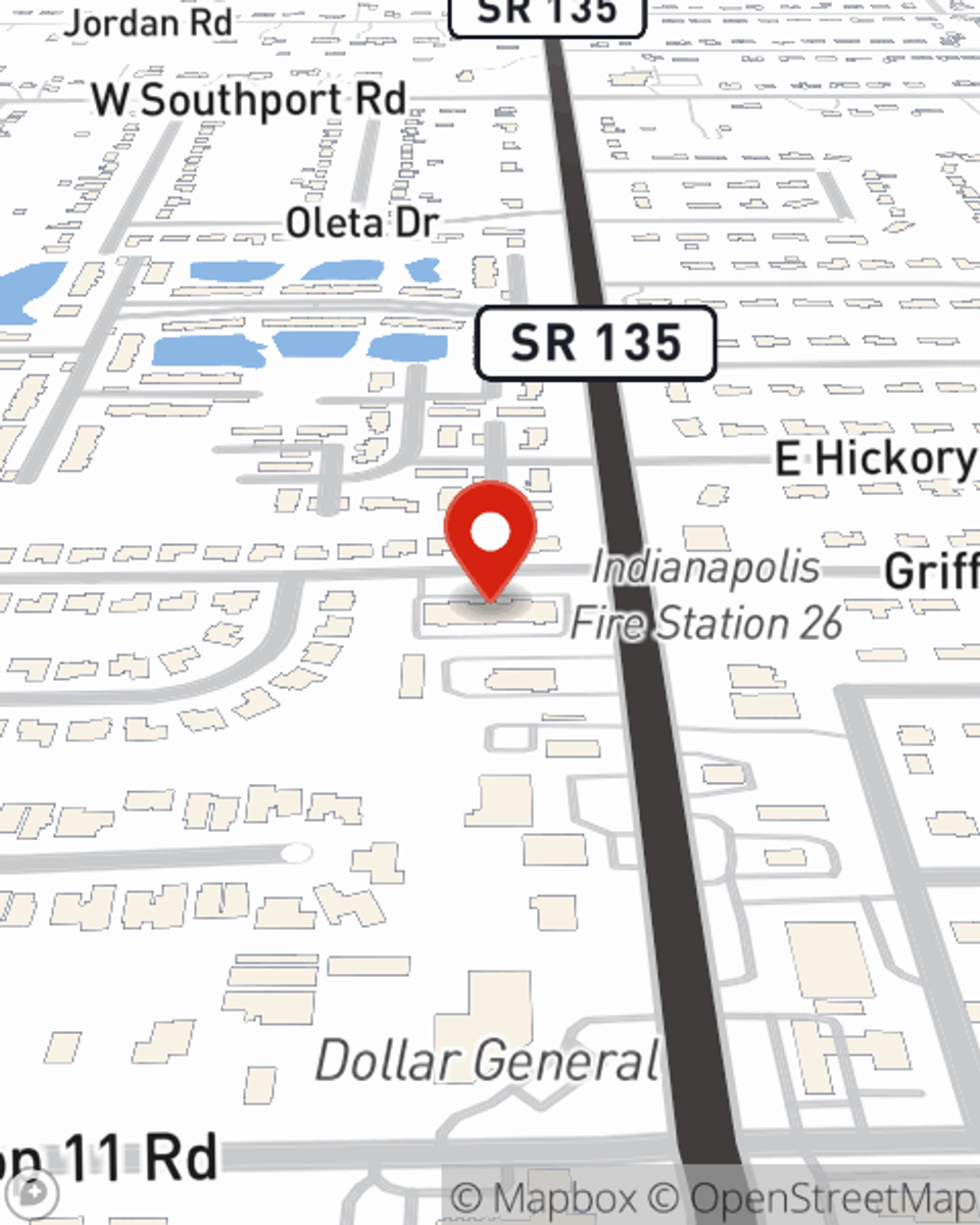

Renters of Indianapolis, call or email Keith Eberg's office to discover your specific options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Keith at (317) 887-1400 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Keith Eberg

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.